Cash out pension calculator

Calculating your penalty for cashing out If all of your contributions were made on a pre-tax basis such as with a 401 k or traditional IRA the calculation is easy. Step 1 of 2 Pension withdrawal Enter the cash lump sum amount you want to take from your pension pot within the tax year 06 Apr 2022 to 05 Apr 2023 Other taxable income.

Pension Calculation Formula Employee Pension Scheme Eps 1995 Youtube

This calculator has been updated for the and 2022-23 2021-22 and 2020-21 tax years.

. Each calculation can be used individually for quick and simple calculations or in. It may be a tax-efficient way to withdraw your whole pension pot. Call us free on 0800 011 3797 or use our webchat.

This calculator will help you figure out. Our assumptions also shown in the results cover how much your pension will grow by each year as well as the. The Pension Calculator is powered by our partner Profile Pensions.

This calculator has been updated for the and 2022-23 2021-22 and 2020-21 tax years. - In this mode you enter your monthly contributions and your employers contributions These are gross the amount you expect to enter your pension after taxes etc. Download our free guide Is a Lump Sum Pension Withdrawal Right for You.

Calculate your estimated Cash Equivalent Transfer Value CETV. You must carry out your own research. If you are unsure the calculator will choose 25.

This cash-balance pension is kept in a safe interest bearing accounts. Discover The Answers You Need Here. Our Pension Drawdown calculator helps you see how much income you could receive with pension drawdown and allows you to compare this with the.

The offer consists of 3 alternatives. Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators. Calculate How Much it Will Cost You to Cash Out Funds Early From Your IRA or 401-k Retirement Plan 2022 Early Retirement Account Withdrawal Tax Penalty Calculator Important.

This calculator is suited to. The Early Withdrawal Calculator the tool allows you to estimate the impact of taking a hypothetical early withdrawal from your retirement account including potential lost asset. Ad Search For Answers From Across The Web With Topsearchco.

Ad Learn the alternatives to your pension plan. There are mainly two options regarding how to receive income from a pension plan. Calculate how much tax youll pay when you withdraw a lump sum from your pension in the 2020-21 2021-22 and 2022-23 tax years.

490 per month when he turns 65. Get your free guide today. Ad Search For Answers From Across The Web With Topsearchco.

Defined benefit pension transfer value calculator. That means you could wind up leaving a lot less cash to your children grandchildren and other beneficiaries. Retirement Calculator Our Retirement Calculator can help a person plan the financial aspects of retirement.

Start pension calculator Need more information on pensions. The scenario involves a 41 year old single male who received a pension buyout offer from a previous employer. This calculator will help you figure out how much income tax youll pay on a lump sum this tax year.

As long as you. The interest credits on your pension balance might be based on the annual interest rate. It can be used for illustrative purposes and can give you an estimate of what you might be able to expect in retirement.

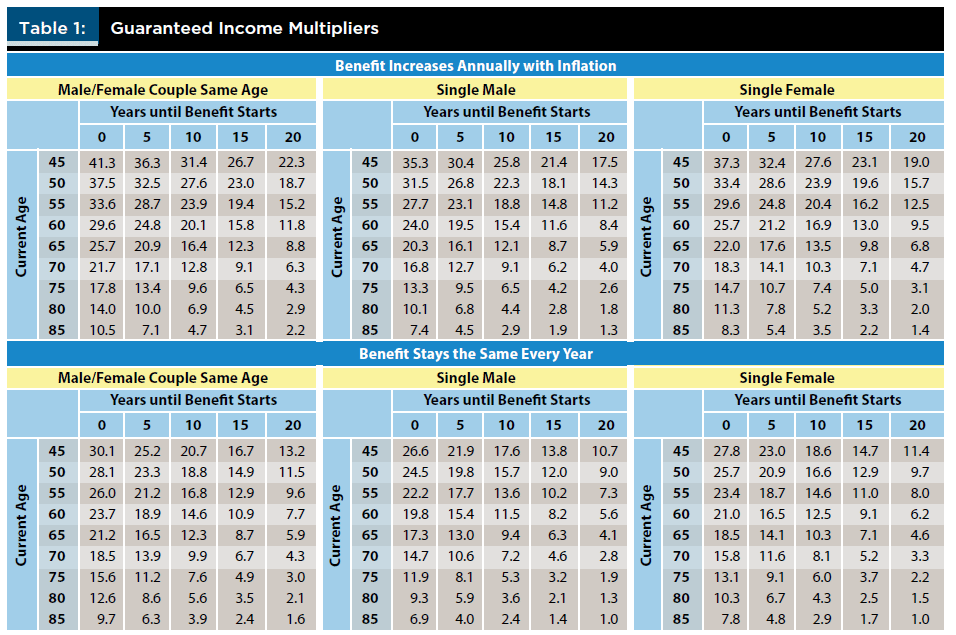

Our Cash-Out Retirement Plan lets you use your pension pot to get regular income payments for between 3 and 25 years. Our Resources Can Help You Decide Between Taxable Vs. The calculator has built into it the interest and mortality rates.

This tool is designed for people retiring at age 55 or older. Pension calculator estimates the size your pot will be at retirement. Ad Jacksons Retirement Calculator Tool Helps Identify Gaps In Your Projected Monthly Income.

Use the Filing Status and Federal Income Tax Rates table to assist you in. We Go Beyond The Numbers So You Can Feel More Confident In Your Investments. The Defined Benefit Plan Calculator provides a FREE Defined Benefit pension calculation.

Because Cash Balance Plans are a type of Defined Benefit Plan this tool also is a Cash. The table below illustrates how you can figure out. Please note that state taxes are entered in a separate entry field.

To use the calculator open the file in Google Sheets then make a copy. Discover The Answers You Need Here. Either take it out as a lump sum payment or have it distributed in a stream of periodic payments until the.

The interest credits on your pension balance might be based on the annual interest rate on 30-year US. You can update the inputs on your copy.

Retirement Withdrawal Calculator For Excel

Ers Georgia State Employees Pension And Savings Plan Gseps Employees Retirement System Of Georgia

Tax Withholding For Pensions And Social Security Sensible Money

What Is A Pension Worth Andrew Marshall Financial Planning

The 10 Best Retirement Calculators Newretirement

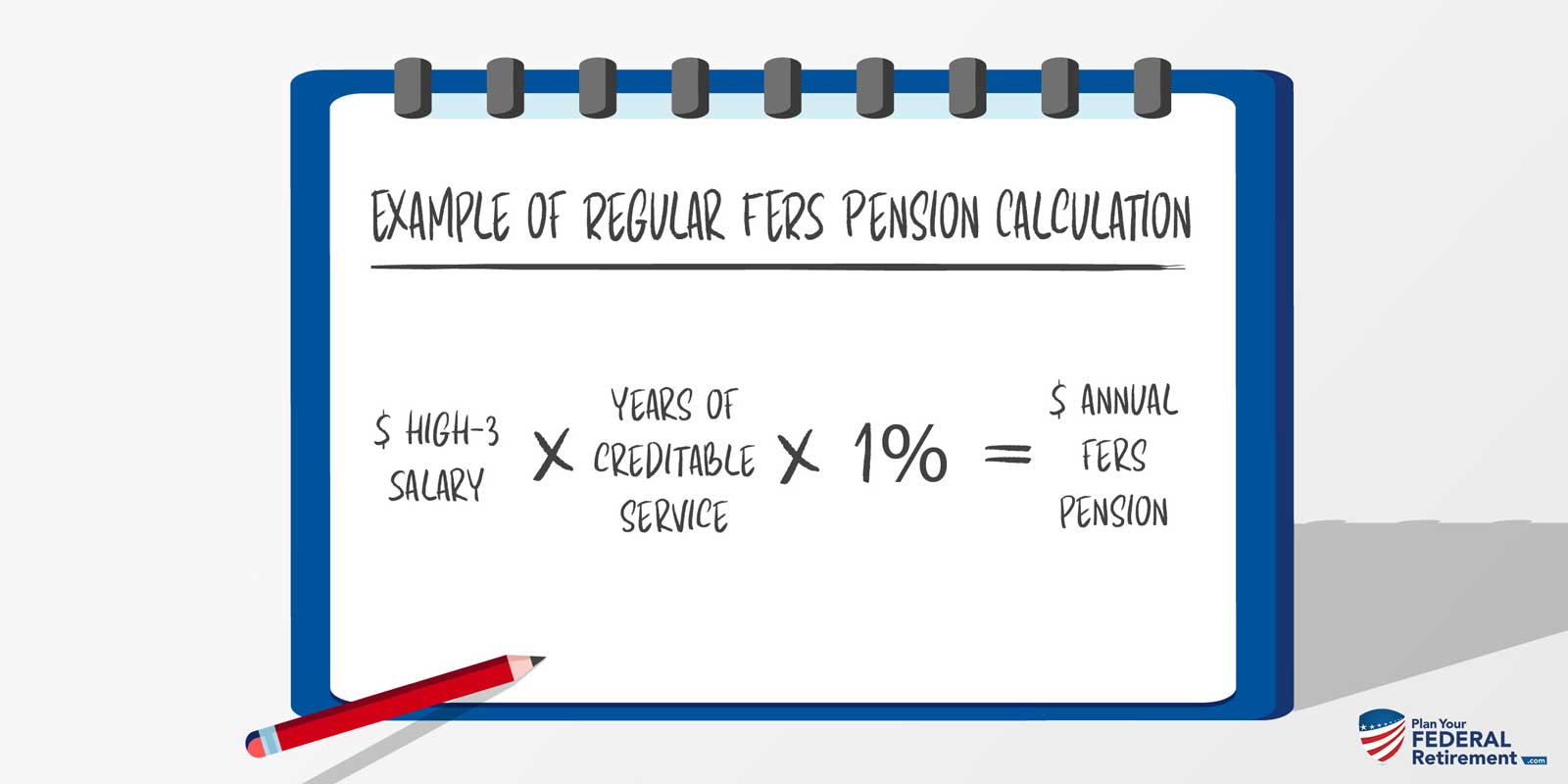

Fers Retirement Special 10 Bonus Age 62 With 20 Years Of Service

Tax Withholding For Pensions And Social Security Sensible Money

Can I Retire At 55 With 300k How Long It Will Last 2020 Financial Ltd

I Built A Spreadsheet To Calculate What It Would Take To Retire Early And It Was A Shock

I Built A Spreadsheet To Calculate What It Would Take To Retire Early And It Was A Shock

Retirement Withdrawal Calculator For Excel

Present Value Of An Annuity Calculator Date Flexibility

Will You Have Enough To Retire The 4 Rule May Help Within Limits

Fire Calculator When Can I Retire Early Engaging Data

Defined Benefit Pension Calculator Cetv Calculator Pensions Salary Calculator

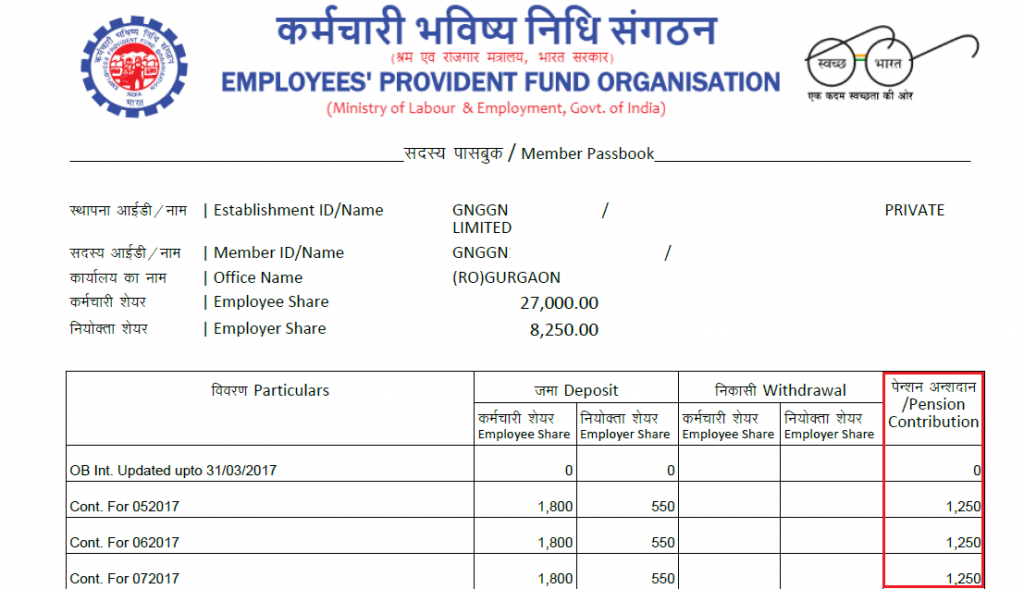

What Is Employees Pension Scheme Eps Eligibility Calculation Formula

2022 Retirement Plan Withdrawals Calculator Calculate Early Withdrawal Income Tax Penalties On Your Ira Or 401k Retirement Savings Plan